december child tax credit amount 2021

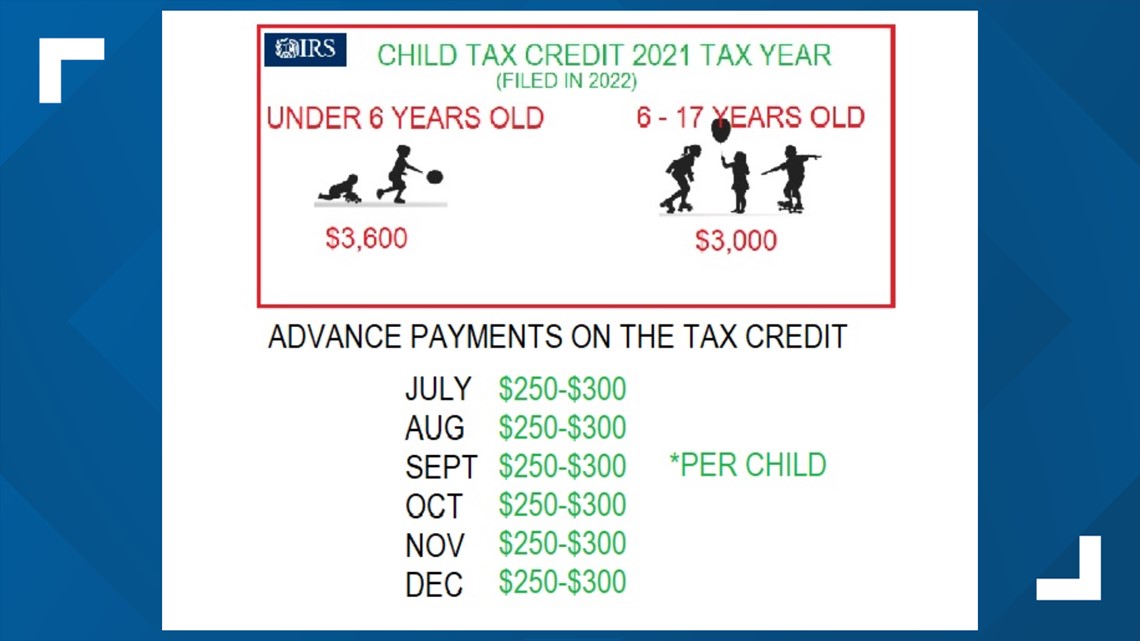

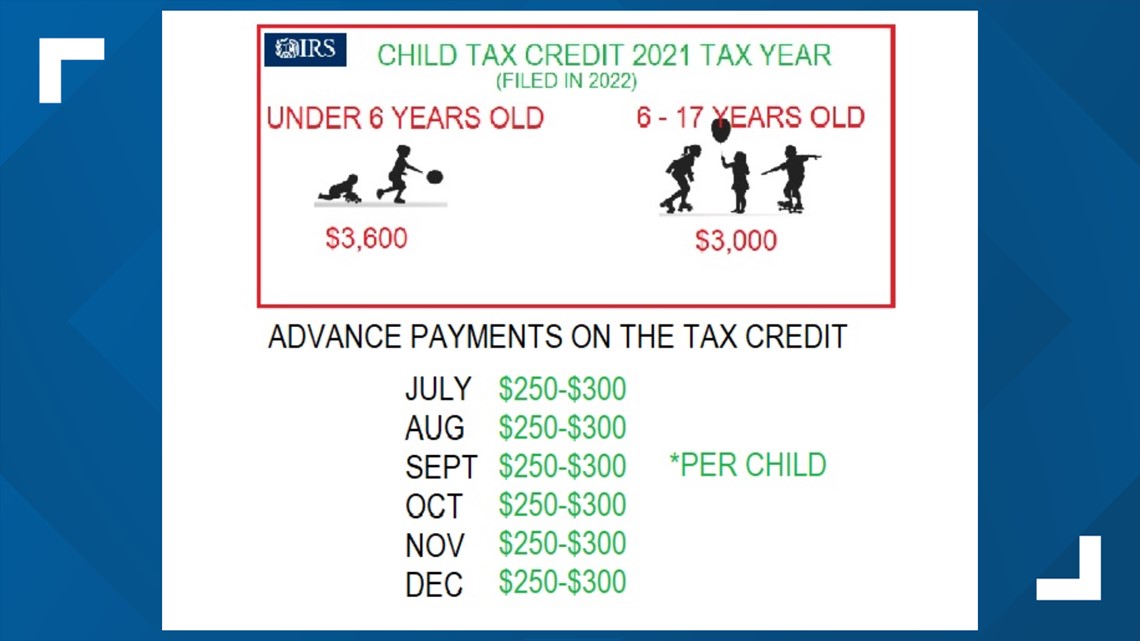

Qualifying families can get up to 3600 per child under 6 years old and. 150000 if you are.

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

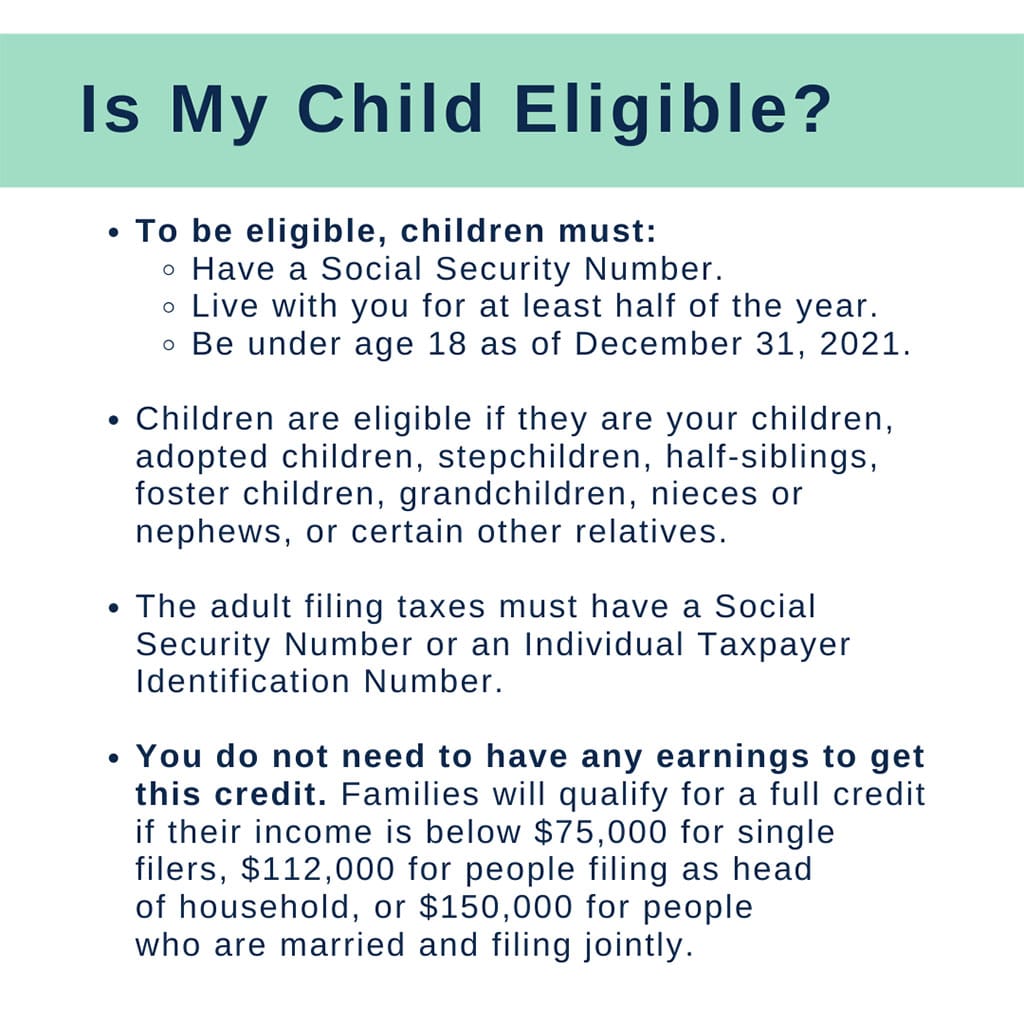

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than.

. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. You can get more when you file. The amount changes to 3000 total for each child ages six.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Increases the tax credit amount. Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes.

The total deposit amounts from July to December will equal 50 of your 2021 eligible Child Tax Credit. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. Families with children between 6 to 17 receive a 3000.

As outlined in the legislation approving the rebates the SCDOR has set the rebate cap the. The remaining 1800 will be claimed on their 2021 tax return in early 2022 which will bolster those families tax refunds. 150000 if married and filing a joint return or if filing as a qualifying widow or.

Why have monthly Child Tax Credit payments. The tax credits maximum amount is 3000 per child and 3600 for children under. The full credit is available for heads of households earning up to.

The CTC will be reduced to 2000 per. The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between. If you receive advance payments in excess of the allowable Child.

2 days agoThe Child Tax Credit has existed for over two decades and was significantly expanded in 2021. But you are still able to receive the full amount of the 2021 Child Tax Credit. 8 hours agoA tax break that assists families in paying for the expenses associated with raising children is the CTC.

1200 in April 2020. The credit amount was increased for 2021. 2 days agoThe rebate amount is based on an individuals 2021 tax liability up to a cap.

Most families are eligible to receive the credit for their children. 600 in December 2020January 2021. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one.

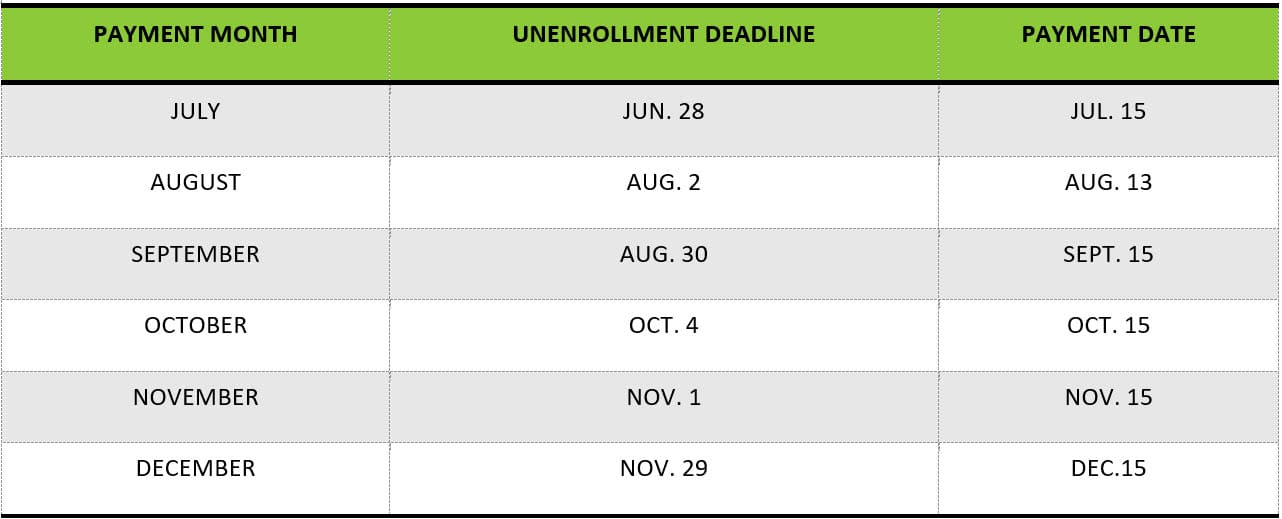

The CTC has been around for more than 20 years and in 2021 it. The 2021 CTC will be reduced in two steps. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment.

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The American Rescue Plan increased the amount of the Child Tax. Specifically the Child Tax Credit was revised in the following ways for 2021.

To get assistance filing for the Child Tax Credit click here. How much will my 2021 Child Tax Credit amount decrease by if I have a higher income.

It S Not Too Late To Claim The 2021 Child Tax Credit

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Using The Child Tax Credit To Boost Your Banking

When Parents Can Expect Their Next Child Tax Credit Payment

What Is The Child Tax Credit Tax Policy Center

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kfox

Center For Siouxland It S Almost Time To File Your Taxes The Irs Is Sending Letters To Those Who Received Advance Child Tax Credit Payments And Or The 3rd Economic Impact Payment Aka

First Phase Ending For Child Tax Credit A Game Changer For Families

About The 2021 Expanded Child Tax Credit Payment Program

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Child Tax Credit Advanced Payments Information Bc T

Claim Advance Child Tax Credit On 2021 Return Filing King5 Com

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Advance Child Tax Credit Financial Education

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities